How Much Will I Get If I Sell My Gold?

Understand the factors that affect how much you’ll receive when selling your gold

If you’re considering selling some gold, but aren’t sure how much it’s worth, this article will help you understand.

You’ll learn:

- The factors that affect how much your gold is worth.

- Why this value can change every day.

- The one thing you have the most control over that will make the biggest difference to the price you receive

Before we begin though, it’s important to understand how gold prices work.

Key takeaways:

- The price you receive for your gold jewelry will depend on the global price of gold on the day you are looking to sell

- Most gold is melted down to be re-used

- Where you sell will make the biggest difference to how much you get. To maximize your sale price, try Alloy Marketplace.

Gold Jewelry Is Usually Melted Down

The first thing to understand about selling gold is that the vast majority of the gold that is sold on the second-hand market is melted down to be used again.

It’s usually recast as gold bullion – gold bars, gold coins etc.

Start with your gold

The gold is taken to a refinery

The gold is melted and repoured

Gold bullion is produced

This means gold buyers view the gold they purely as a raw material, rather than a valued heirloom or sentimental piece of jewelry. If you’ve inherited jewelry and are considering selling it, it’s essential to know the best way to sell inherited jewelry, as the process might differ slightly from selling regular gold items.”

For gold buyers, the key thing that determines the amount you will be paid is the amount of raw gold that your item contains.

The flipside of this is that gold is a very valuable material, and it can be surprising how much even a small amount of gold can be worth.

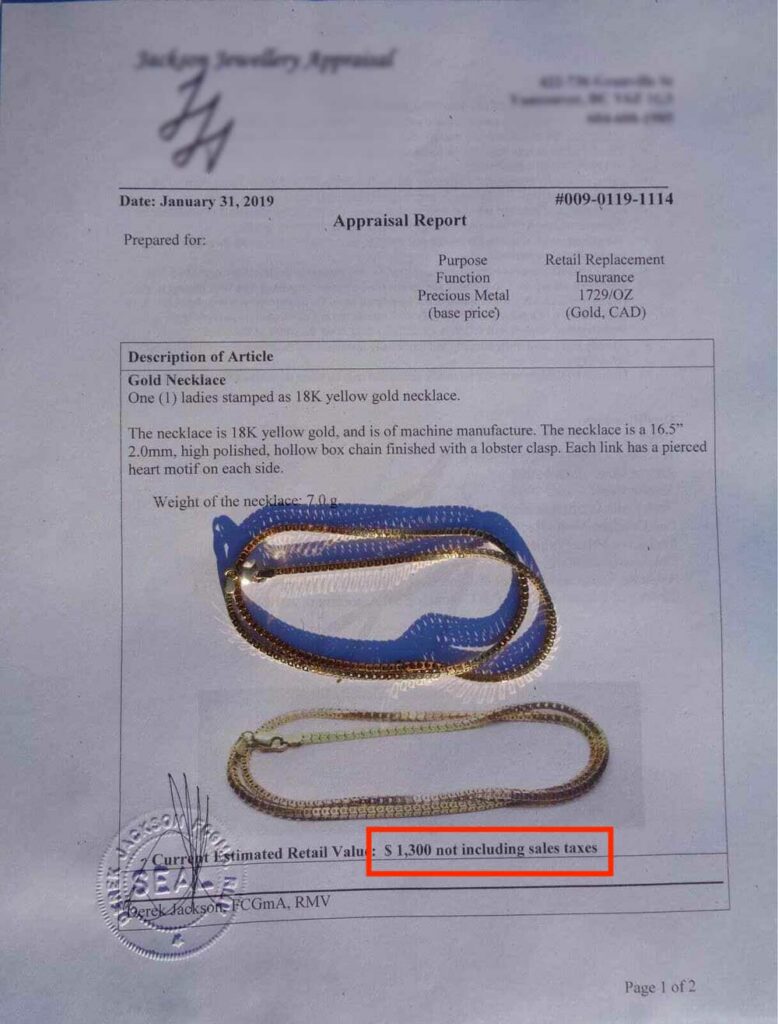

Appraised Value of Gold Jewelry vs. What You Will Receive

If you have ever had any gold jewellery appraised for insurance purposes, this may set an expectation of the amount of money you are likely to receive for it when it comes to selling it.

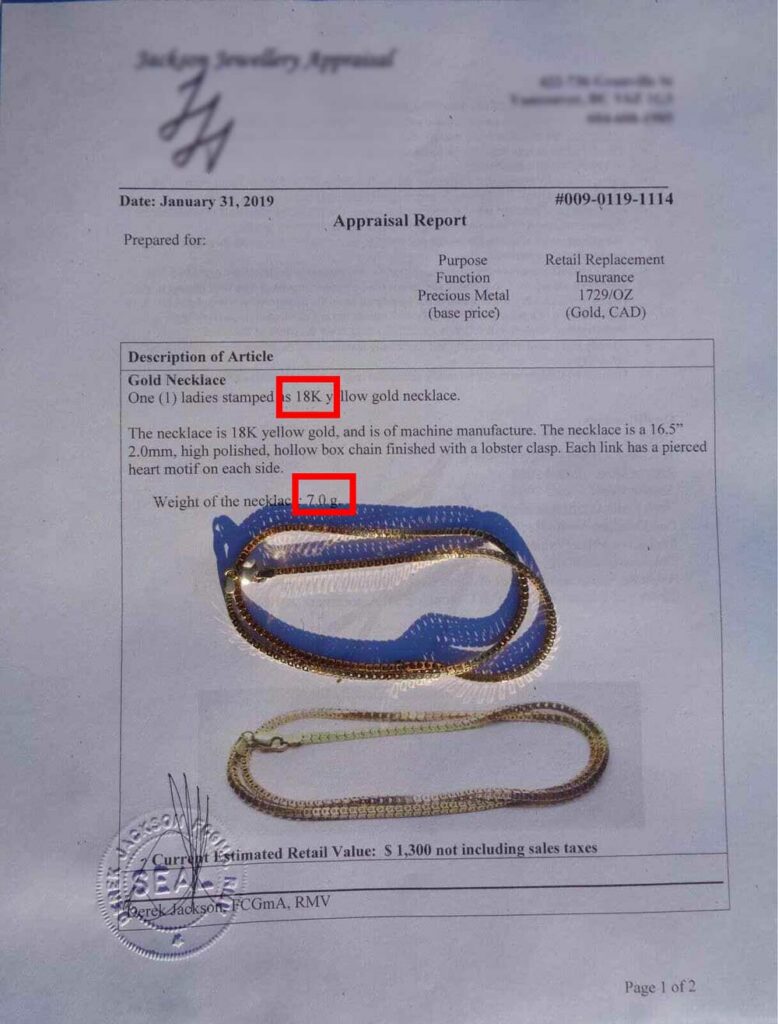

In the example below, this 18 karat gold necklace has been appraised for $1,300:

This appraisal means that if this necklace was stolen or lost, the insurance company would pay the owner $1,300 to allow them to buy a replacement.

However, the price that this necklace could be sold for would be significantly lower – it would only be worth the value of the raw gold that the necklace contains.

We’ll look at this in detail later, but the raw material in 18k necklace that weighs 7g and has been appraised for $1,300 is actually worth around $330.

The necklace would actually be able to be sold for even less than that.

The exception to this is gold jewelry that can be more valuable as jewelry rather than just the value of the raw materials is ‘signed’ jewelry. This is jewelry from a ‘name brand’ like Cartier, Tiffany & Co. or Van Cleef & Arpels:

If you have gold jewelry from one of these premium brands, it’s best to sell them to someone within the jewelry industry who will value them as a piece of jewelry, rather than for the raw materials they contain.

Factors That Affect How Much You Will Receive When You Sell Your Gold

There are four key factors that affect how much you will receive when selling your gold:

- The current market price,

- The purity of your gold,

- Your item’s weight

- The offer from a prospective buyer.

Each of these plays role in determining how much you’ll receive.

However, there’s one that makes the biggest difference to the amount you receive and it’s also the one you have the most control over – the offer from a prospective buyer.

We’ll look at each these in turn so you can understand how much you are likely to receive when selling your gold, we well as how to get the best price possible.

1. How the Market Price Affects Your Gold Sale

At the heart of how much you’ll receive for your gold is the concept of the “spot price”.

The gold spot price is the current price that gold is being sold on the international gold markets – worldwide financial markets that trade gold in huge quantities

The current price gold is being traded at depends on a huge number of factors like the strength of the US$, economic stability, and geopolitical events.

The gold spot price changes in real-time and is the same all over the world, but can be expressed in different currencies. In the United States, spot price is shown as US dollars per ounce, while in Europe, they use Euros per gram.

Today – 25th May – the spot price of gold stands at $1,958.83 per ounce, which is higher than it has been for much of the last two years.

While there has been some fluctuation, the general trend has been an increase.

If you aren’t in a rush, keeping an eye on the spot price can be a good idea if you have gold to sell.

There’s been around a 20% swing in gold prices over the last 12 months from a low of $1,628 per ounce to a high of $2,048 per ounce:

Needless to say, this would make a significant difference to how much you would receive when selling.

How Gold Purity Affects the Value of Your Sale

The purity of your gold is a crucial factor determining the price you’ll receive when selling your gold.

Gold purity refers to the amount of gold in a piece compared to other metals.

It’s often measured in karats, with 24 karats indicating pure gold.

In percentage terms, 24 karats equates to 100% gold content, while 12 karat is 50% pure gold.

The further down you go on the “karat” scale the less pure your gold is:

| Karat | Parts gold | Purity |

|---|---|---|

| 24 karat gold | 24/24 | 100% pure gold |

| 22 karat gold | 22/24 | 91.6% pure gold |

| 18 karat gold | 18/24 | 75% pure gold |

| 14 karat gold | 14/24 | 58.5% pure gold |

| 12 karat gold | 12/24 | 50% pure gold |

| 10 karat gold | 10/24 | 41.7% pure gold |

| 9 karat gold | 9/24 | 37.5% pure gold |

The amount of raw gold in your item will affect the price that you will be able to sell it for.

So, if two gold necklaces weight the same, but one necklace is 12 karat gold and the other is 18 karat gold, the 18 karat gold has 50% more gold in it, so is 50% more valuable.

How Weight Influences The Amount You’ll Receive For Your Gold

As we’ve covered, it’s the weight of the raw gold that determines how much your gold is worth when you come to sell.

If you’re looking to understand how much you will get if you sell your gold, it’s important therefore to understand how much the gold item as a whole weighs, and from that weight it’s easy to calculate how much gold it contains.

The best way to do this is with a jeweler’s scale, which are much more sensitive than most kitchen scales:

Inexpensive jewellers scales can be bought from Amazon for less than $9, or a jewelry store will usually weigh items for you at no cost.

From the weight of the item, it’s easy to calculate the weight of the actual gold it contains – apply the percentage that corresponds to its karat weight to the total weight of the item.

If we look again at the chain that was appraised, it weighs 7 grams and is 18 karat gold:

As we found out earlier, 18k gold is 75.3% pure.

This means that the the 7 gram chain actually contains 75.3% of 7 grams = 5.27g of actual gold.

Calculating the ‘melt value’ of your gold

Now we’re getting closer to learning how much your gold item is actually worth.

‘Melt value’ refers to the inherent value of a piece of gold ie. how much it would be worth if you melted down the item and sold it as raw gold at 100% of that day’s spot value.

Essentially, melt value is how much the gold in your item would be worth if it was sold for the 100% of the current spot price.

Calculating the melt value is pretty simple too – we just need the pieces of information we’ve just talked through (spot price, purity and weight) and then multiply these three values together.

The one complication is that spot price is given in $ per ounce, so we also need to complete this conversion.

Our 7g 5.27 grams = 0.168 ounces (since 1 gram = 0.032 troy ounces)

Here’s what we end up with for our bracelet:

- Weight of bracelet: 7g

- Purity: 18k

- Weight of gold in g: 5.27

1 gram = 0.032 troy ounces, so we multiply 5.27g of gold by 0.032 to give us 0.168 ounces.

Finally, we multiply this value by the current spot price:

- Weight of gold in ounces: 0.168 ounces

- Spot price: $1,958.83 per ounce

Amount of gold in ounces (0.168) x spot price ($1,958.83 per ounce) = $329.08

Again, it’s important to remember that the current market price of gold fluctuates daily, so this will change.

How the Buyer’s Offer Impacts Your Gold Sale

We’ve just calculated the ‘melt price’ of the gold – how much it is worth at 100% of the ‘spot price’.

In reality, anyone who you are going to sell gold to will offer you a % of that day’s spot price. After all, they need to pay their overheads, pay their staff,

What can be surprising is how much the offer you receive can vary from buyer to buyer.

Different buyers might offer varying prices based on their business model, overhead costs, profit margins, and the current demand for gold. This is why shopping around for the best offer is crucial when you’re ready to sell.

Different types of buyers include online buyers, local jewelers, pawn shops, and gold parties, each with their unique pricing structures.

For instance, establishments that post signs offering to buy gold may provide just 40 to 45% of the melt value. This is due to their high overhead costs, including rents, staff salaries, and other operational expenses, which they need to cover while still making a profit.

Pawn shops may offer even less, with offers as low as 20% of the melt value. While they provide the convenience of immediate cash, this comes at the cost of lower returns for your gold.

Online gold buying services, often provide the highest offers. Their business models typically have lower overheads as they do not need to maintain physical retail spaces or extensive staff. This allows them to pass on these savings to you in the form of higher offers.

Additional Costs to Consider When Selling Your Gold

When calculating the potential returns from selling your gold, it’s essential to factor in additional costs that might eat into your profits.

These costs include:

- assaying fees

- transaction fees

- shipping and insurance fees.

Assaying fees apply if you need to verify the purity of your gold. An assay test is a process that accurately determines the content of your gold piece. While it’s not always necessary to have your gold assayed before selling it, in some cases, especially with unmarked gold or if there’s any doubt about its purity, it could be beneficial. However, these tests usually come with a fee, which you’ll need to account for.

Transaction fees are another cost to consider. If you’re selling online or through a service that uses an online payment gateway, you might be charged a fee to process the transaction. These fees vary but can range from 2-3% of the total sale value.

Finally, if you’re selling your gold to an online buyer or shipping it to a different location, there are shipping and insurance costs to consider. While some buyers offer free shipping, others might charge you for this service. Additionally, insuring your package is highly recommended, especially when shipping high-value gold pieces. The cost of insurance will usually depend on the value of the gold you’re sending.

Apart from these direct costs, if you’ve inherited the gold jewelry you’re considering selling, there might be tax implications to consider. Learn more about the tax on inherited jewelry to ensure you’re fully informed.

By factoring in these costs, you’ll have a more realistic understanding of what your net return will be when selling your gold. Remember, the goal is to maximize your return, so it’s worth shopping around to find services with the most reasonable fees.

How To Find Out How Much Your Gold is Worth Today

One of the most effective ways to find the current value of your gold is by submitting it for an estimate. This process allows you to understand the potential return you can expect from selling your gold in today’s market.

An excellent resource for this is Alloy, a new gold marketplace. They provide an intuitive estimation calculator on their website, designed to provide an instant valuation for your gold. This tool takes into consideration the weight, purity, and current market price of gold to calculate a fair estimate of your gold’s worth.

Using Alloy’s estimation calculator, you can instantly find out how much you could potentially receive for your gold, aiding your decision-making process and ensuring you’re well-informed before making a sale.

Alloy focuses on transparency and fairness throughout the process of buying your gold, so you get the best possible value for your items

- Attentive, personalised service

- Great prices paid

- Smooth transaction

How Much Will I Get If I Sell My Gold? FAQs

Gold prices are set on the international market and fluctuate based on supply and demand factors, including economic stability, central bank reserves, and investor behavior.

The amount you receive depends on the current gold price, the weight and purity of your gold, and the fees or commissions charged by the buyer. The value of any accompanying gemstones, the design and condition of gold jewelry can also influence the price.

It depends on the coin and the jewelry. Gold coins might fetch higher prices if they are rare or collectible. Gold jewelry might be worth more if it has historical significance or exceptional craftsmanship. However, for their gold content alone, both should be worth similar amounts.

If the gemstones in your gold are valuable, they can add to the overall price. However, not all buyers have the expertise to value gemstones, so you might need to sell them separately to get the best price.

This will depend on where you are selling to, but a good guide is that an offer should never be less than 70% of the spot price for scrap gold. The exact percentage can depend on a variety of factors, including the buyer’s margins, the quantity and quality of gold you’re selling, and current market conditions.

The IRS views gold is as a capital asset, with any gains taxed as income.

What this means for selling gold jewelry is that if you sell the jewelry for more than was paid for it, you should count the difference between the two as taxable income. Capital gains on collectibles, including gold jewelry, are taxed at 28%.

For example, if a bracelet was bought for $100 and sold for $200, you have made a gain of $100. Tax would therefore be $28.

In reality, it’s unlikely that the amount you receive will be more than you paid for it, so you shouldn’t have to worry about this.