Blue Nile Sales Tax

Your guide to Blue Nile taxes for every state in the USA

Blue Nile have an amazing selection of beautiful engagement rings at super competitive prices.

But understanding the final price can be tricky as the prices on the site don’t factor in the sales tax for your state.

To make it more complicated, tax is payable in some states, but not others.

Read on to find out whether you’ll have to pay tax on your purchase and how much you’ll pay.

If you want to see Blue Nile’s information on sales tax, click here.

Sales Tax

As you know, sales tax varies from state to state. Each state has a state wide sales tax and a local sales tax, the state wide tax is always the same across the state, but the local sales tax may vary, depending on what county you’re based in.

The tax rates below are current as at of January 2023. The information on each state’s individual sales tax is taken from Tax Foundation.

We’ve also written an indepth review about Blue Nile if you want to read more.

States where Blue Nile does collect sales tax

Currently, Blue Nile collects sales tax on orders shipped to addresses in Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Nevada, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington DC, Washington State, West Virginia, Wisconsin and Wyoming.

Read related article: Blue Nile Financing

States where Blue Nile does not collect sales tax

This means that Blue Nile does not collect sales tax in the following states: Alaska, Delaware, Montana, New Hampshire, Oregon

Read related article: Blue Nile Ring Box

State by state guide to Blue Nile Sales tax

Blue Nile sales tax in Alabama

The state sales tax is 4% and the average local sales tax rate is 5.22%, which brings the combined sales tax rate to 9.22%.

However the local sales tax rate can be as high as 7.50%, which would mean the maximum combined sales tax could be 11.50%

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Alaska

There is no state sales tax but the average local sales tax rate is 1.76%. However the local sales tax rate can be as high as 7.50%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Arizona

The state sales tax is 5.60% and the average local sales tax rate is 2.80%, which brings the combined sales tax rate to 8.40%.

However the local sales tax rate can be as high as 5.60%, which would mean the maximum combined sales tax could be 11.20%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Arkansas

The state sales tax is 6.50% and the average local sales tax rate is 3.01%, which brings the combined sales tax rate to 9.51%.

However the local sales tax rate can be as high as 5.125%, which would mean the maximum combined sales tax could be 11.625%

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in California

The state sales tax is 7.25% and the average local sales tax rate is 1.43%, which brings the combined sales tax rate to 8.68%.

However the local sales tax rate can be as high as 2.50%, which would mean the maximum combined sales tax could be 9.75%

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Colorado

The state sales tax is 2.90% and the average local sales tax rate is 4.82%, which brings the combined sales tax rate to 7.72%.

However the local sales tax rate can be as high as 8.30%, which would mean the maximum combined sales tax could be 11.20%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in the District of Columbia (Washington D.C)

The state sales tax is 6% but here’s no local state tax, which means the most you’ll ever pay for sales tax in D.C is 6%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Connecticut

The state sales tax is 6.35% but here’s no local state tax, which means the most you’ll ever pay for sales tax in Connecticut is 6.35%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Georgia

The state sales tax is 4% and the average local sales tax rate is 3.32%, which brings the combined sales tax rate to 7.32%.

However the local sales tax rate can be as high as 4.90%, which would mean the maximum combined sales tax could be 8.90 %.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Hawaii

The state sales tax is 4% and the average local sales tax rate is 0.44%, which brings the combined sales tax rate to 4.44%.

However the local sales tax rate can be as high as 0.50%, which would mean the maximum combined sales tax could be 4.50%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Idaho

The state sales tax is 6% and the average local sales tax rate is 0.03%, which brings the combined sales tax rate to 6.03%.

However the local sales tax rate can be as high as 3%, which would mean the maximum combined sales tax could be 9%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Illinois

The state sales tax is 6.25% and the average local sales tax rate is 2.57%, which brings the combined sales tax rate to 8.82%.

However the local sales tax rate can be as high as 9.75%, which would mean the maximum combined sales tax could be 16%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Indiana

The state sales tax is 7% but here’s no local state tax. Which means the most you’ll ever pay for sales tax in Indiana is 7%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Iowa

The state sales tax is 6% and the average local sales tax rate is 0.94%, which brings the combined sales tax rate to 6.94%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 7%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Kansas

The state sales tax is 6.5% and the average local sales tax rate is 0.94%, which brings the combined sales tax rate to 6.94%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 7.5%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Kentucky

The state sales tax is 6% but here’s no local state tax. Which means the most you’ll ever pay for sales tax in Kentucky is 6%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Louisiana

The state sales tax is 4.45% and the average local sales tax rate is 5.07%, which brings the combined sales tax rate to 9.52%.

However the local sales tax rate can be as high as 7%, which would mean the maximum combined sales tax could be 11.45%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Maine

The state sales tax is 5.5% but here’s no local state tax, which means the most you’ll ever pay for sales tax in Maine is 5.5%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Maryland

The state sales tax is 6% but here’s no local state tax. Which means the most you’ll ever pay for sales tax in Maryland is 6%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Massachusetts

The state sales tax is 6.25% but here’s no local state tax, which means the most you’ll ever pay for sales tax in Massachusetts is 6.25%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Michigan

The state sales tax is 6% but here’s no local state tax, which means the most you’ll ever pay for sales tax in Michigan is 6%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Minnesota

The state sales tax is 6.87% and the average local sales tax rate is 0.59%, which brings the combined sales tax rate to 7.46%.

However the local sales tax rate can be as high as 2%, which would mean the maximum combined sales tax could be 8.87%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Mississippi

The state sales tax is 7% and the average local sales tax rate is 0.07%, which brings the combined sales tax rate to 7.07%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 8%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Nebraska

The state sales tax is 5.50% and the average local sales tax rate is 1.44%, which brings the combined sales tax rate to 6.94%.

However the local sales tax rate can be as high as 2.50%, which would mean the maximum combined sales tax could be 8%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Nevada

The state sales tax is 6.85% and the average local sales tax rate is 1.38%, which brings the combined sales tax rate to 8.23%.

However the local sales tax rate can be as high as 1.53%, which would mean the maximum combined sales tax could be 8.38%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in New Jersey

The state sales tax is 6.625% and the average local sales tax rate is -0.03% (this anomaly is thanks to Salem County which is not subject to the state rate, and has a local rate of 3.3125%) which brings the combined sales tax rate to 6.60%.

However the local sales tax rate can be as high as 3.313%, which would mean the maximum combined sales tax could be 9.938%

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in New Mexico

The state sales tax is 5.125% and the average local sales tax rate is 2.71%, which brings the combined sales tax rate to 7.83%.

However the local sales tax rate can be as high as 4.313%, which would mean the maximum combined sales tax could be 9.438%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in New York

The state sales tax is 4% and the average local sales tax rate is 4.52%, which brings the combined sales tax rate to 8.52%.

However the local sales tax rate can be as high as 4.875%, which would mean the maximum combined sales tax could be 8.875%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in North Carolina

The state sales tax is 4.75% and the average local sales tax rate is 2.23%, which brings the combined sales tax rate to 6.98%.

However the local sales tax rate can be as high as 2.75%, which would mean the maximum combined sales tax could be 7.5%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in North Dakota

The state sales tax is 5% and the average local sales tax rate is 1.96%, which brings the combined sales tax rate to 6.96 %.

However the local sales tax rate can be as high as 3.50%, which would mean the maximum combined sales tax could be 8.50%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Ohio

The state sales tax is 5.75% and the average local sales tax rate is 1.48%, which brings the combined sales tax rate to 7.23%.

However the local sales tax rate can be as high as 2.25%, which would mean the maximum combined sales tax could be 8%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Oklahoma

The state sales tax is 4.5% and the average local sales tax rate is 4.45%, which brings the combined sales tax rate to 8.95%.

However the local sales tax rate can be as high as 7%, which would mean the maximum combined sales tax could be 11.5%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Pennsylvania

The state sales tax is 6% and the average local sales tax rate is 0.34%, which brings the combined sales tax rate to 6.34%.

However the local sales tax rate can be as high as 2%, which would mean the maximum combined sales tax could be 8%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Rhode Island

The state sales tax is 7% but here’s no local state tax. Which means the most you’ll ever pay for sales tax in Rhode Island is 7%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in South Carolina

The state sales tax is 6% and the average local sales tax rate is 1.46%, which brings the combined sales tax rate to 7.46%.

However the local sales tax rate can be as high as 3%, which would mean the maximum combined sales tax could be 9%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in South Dakota

The state sales tax is 4.5% and the average local sales tax rate is 1.9%, which brings the combined sales tax rate to 6.4%.

However the local sales tax rate can be as high as 4.5%, which would mean the maximum combined sales tax could be 9%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Tennessee

The state sales tax is 7% and the average local sales tax rate is 2.55%, which brings the combined sales tax rate to 9.55%.

However the local sales tax rate can be as high as 2.75%, which would mean the maximum combined sales tax could be 9.75%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Texas

The state sales tax is 6.25% and the average local sales tax rate is 1.94%, which brings the combined sales tax rate to 8.19%.

However the local sales tax rate can be as high as 2%, which would mean the maximum combined sales tax could be 8.25%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Utah

The state sales tax is 6.1% and the average local sales tax rate is 1.09%, which brings the combined sales tax rate to 7.19%.

However the local sales tax rate can be as high as 2.95%, which would mean the maximum combined sales tax could be 9.05 %.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Vermont

The state sales tax is 6% and the average local sales tax rate is 0.24%, which brings the combined sales tax rate to 6.24%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 7%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Virginia

The state sales tax is 5.3% and the average local sales tax rate is 0.43%, which brings the combined sales tax rate to 5.73%.

However the local sales tax rate can be as high as 0.7%, which would mean the maximum combined sales tax could be 6%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Washington

The state sales tax is 6.5% and the average local sales tax rate is 2.73%, which brings the combined sales tax rate to 9.23%.

However the local sales tax rate can be as high as 4%, which would mean the maximum combined sales tax could be 10.5%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in West Virginia

The state sales tax is 6% and the average local sales tax rate is 0.5%, which brings the combined sales tax rate to 6.5%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 7%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Wisconsin

The state sales tax is 5% and the average local sales tax rate is 0.43%, which brings the combined sales tax rate to 5.43%.

However the local sales tax rate can be as high as 1.75%, which would mean the maximum combined sales tax could be 6.75%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile sales tax in Wyoming

The state sales tax is 4% and the average local sales tax rate is 1.33%, which brings the combined sales tax rate to 5.33%.

However the local sales tax rate can be as high as 2%, which would mean the maximum combined sales tax could be 6%.

See Blue Niles sales tax information here, or start building your ring here.

Blue Nile will charge you the correct amount of tax

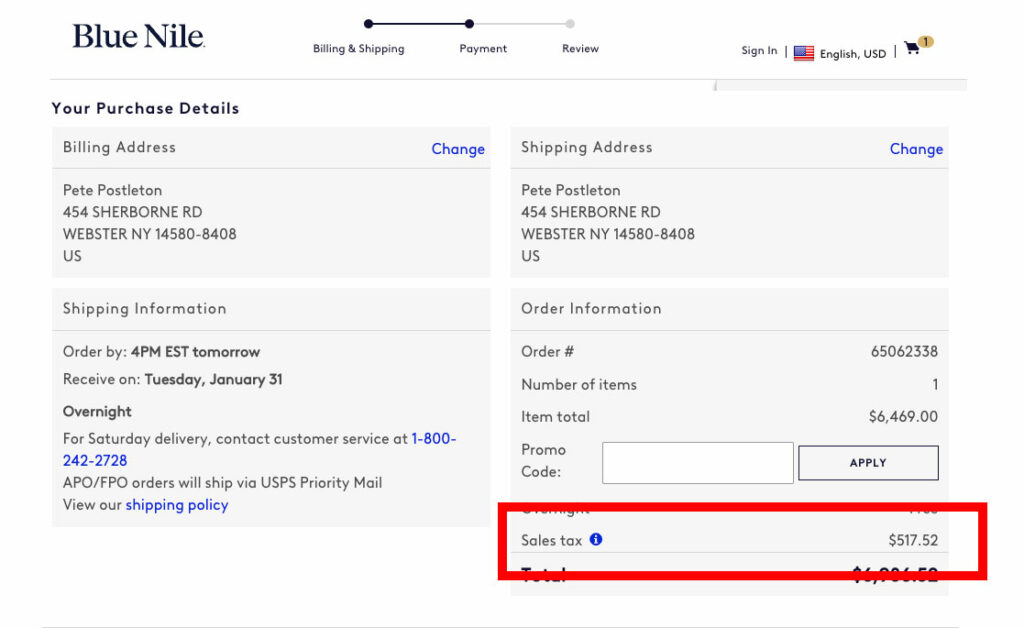

Blue Nile calculates the tax for you in the cart, and it’s will be included in the total amount you have to pay. This is made transparent in the cart totals and you’ll be able to see this after you enter in a shipping address.

Is there any way you can avoid paying tax?

To avoid paying sales tax when buying from Blue Nile, you’d need to either live in Alaska, Delaware, Montana, New Hampshire or Oregon, or know someone that lives in those states and get the ring sent to them, and then get them to send it to you.

If you wanted to pay less tax, you could get the ring mailed to another state that has a lower tax rate. If you have time up your sleeve this might be worth your while.

Find out more on Blue Nile