James Allen Sales Tax

Your guide to James Allen taxes for every state in the USA

James Allen have an amazing selection of beautiful engagement rings at super competitive prices.

But understanding the final price can be tricky as the prices on the site don’t factor in the sales tax for your state.

To make it more complicated, tax is payable in some states, but not others.

Luckily James Allen have an easy to use Tax Calculator, or read on to find out whether you’ll have to pay tax on your purchase and how much you’ll pay.

Or jump straight into their tax calculator click here.

Sales Tax

As you know, sales tax varies from state to state. Each state has a state wide sales tax and a local sales tax, the state wide tax is always the same across the state, but the local sales tax may vary, depending on what county you’re based in.

The tax rates below are current as at of January 2021. The information on each state’s individual sales tax is taken from Tax Foundation.

We’ve also written an in-depth review about James Allen, click the link for more.

James Allen sales tax in Alabama

The state sales tax is 4% and the average local sales tax rate is 5.22%, which brings the combined sales tax rate to 9.22%.

However the local sales tax rate can be as high as 7.50%, which would mean the maximum combined sales tax could be 11.50%

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Alabama.

James Allen sales tax in Alaska

There is no state sales tax but the average local sales tax rate is 1.76%. However the local sales tax rate can be as high as 7.50%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Alaska.

James Allen sales tax in Arizona

The state sales tax is 5.60% and the average local sales tax rate is 2.80%, which brings the combined sales tax rate to 8.40%.

However the local sales tax rate can be as high as 5.60%, which would mean the maximum combined sales tax could be 11.20%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Arizona.

James Allen sales tax in Arkansas

The state sales tax is 6.50% and the average local sales tax rate is 3.01%, which brings the combined sales tax rate to 9.51%.

However the local sales tax rate can be as high as 5.125%, which would mean the maximum combined sales tax could be 11.625%

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Arkansas.

James Allen sales tax in California

The state sales tax is 7.25% and the average local sales tax rate is 1.43%, which brings the combined sales tax rate to 8.68%.

However the local sales tax rate can be as high as 2.50%, which would mean the maximum combined sales tax could be 9.75%

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from California

James Allen sales tax in Colorado

The state sales tax is 2.90% and the average local sales tax rate is 4.82%, which brings the combined sales tax rate to 7.72%.

However the local sales tax rate can be as high as 8.30%, which would mean the maximum combined sales tax could be 11.20%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Colorado.

James Allen sales tax in the District of Columbia (Washington D.C)

The state sales tax is 6% but here’s no local state tax, which means the most you’ll ever pay for sales tax in D.C is 6%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Washington DC.

James Allen sales tax in Connecticut

The state sales tax is 6.35% but here’s no local state tax, which means the most you’ll ever pay for sales tax in Connecticut is 6.35%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Connecticut.

James Allen sales tax in Georgia

The state sales tax is 4% and the average local sales tax rate is 3.32%, which brings the combined sales tax rate to 7.32%.

However the local sales tax rate can be as high as 4.90%, which would mean the maximum combined sales tax could be 8.90 %.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Georgia.

James Allen sales tax in Hawaii

The state sales tax is 4% and the average local sales tax rate is 0.44%, which brings the combined sales tax rate to 4.44%.

However the local sales tax rate can be as high as 0.50%, which would mean the maximum combined sales tax could be 4.50%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Hawaii.

James Allen sales tax in Idaho

The state sales tax is 6% and the average local sales tax rate is 0.03%, which brings the combined sales tax rate to 6.03%.

However the local sales tax rate can be as high as 3%, which would mean the maximum combined sales tax could be 9%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Idaho.

James Allen sales tax in Illinois

The state sales tax is 6.25% and the average local sales tax rate is 2.57%, which brings the combined sales tax rate to 8.82%.

However the local sales tax rate can be as high as 9.75%, which would mean the maximum combined sales tax could be 16%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Illinois.

James Allen sales tax in Indiana

The state sales tax is 7% but here’s no local state tax. Which means the most you’ll ever pay for sales tax in Indiana is 7%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Indiana.

James Allen sales tax in Iowa

The state sales tax is 6% and the average local sales tax rate is 0.94%, which brings the combined sales tax rate to 6.94%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 7%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Iowa.

James Allen sales tax in Kansas

The state sales tax is 6.5% and the average local sales tax rate is 0.94%, which brings the combined sales tax rate to 6.94%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 7.5%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Kansas.

James Allen sales tax in Kentucky

The state sales tax is 6% but here’s no local state tax. Which means the most you’ll ever pay for sales tax in Kentucky is 6%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Kentucky.

James Allen sales tax in Louisiana

The state sales tax is 4.45% and the average local sales tax rate is 5.07%, which brings the combined sales tax rate to 9.52%.

However the local sales tax rate can be as high as 7%, which would mean the maximum combined sales tax could be 11.45%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Louisiana.

James Allen sales tax in Maine

The state sales tax is 5.5% but here’s no local state tax, which means the most you’ll ever pay for sales tax in Maine is 5.5%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Maine.

James Allen sales tax in Maryland

The state sales tax is 6% but here’s no local state tax. Which means the most you’ll ever pay for sales tax in Maryland is 6%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Maryland.

James Allen sales tax in Massachusetts

The state sales tax is 6.25% but here’s no local state tax, which means the most you’ll ever pay for sales tax in Massachusetts is 6.25%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Massachusetts.

James Allen sales tax in Michigan

The state sales tax is 6% but here’s no local state tax, which means the most you’ll ever pay for sales tax in Michigan is 6%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Michigan.

James Allen sales tax in Minnesota

The state sales tax is 6.87% and the average local sales tax rate is 0.59%, which brings the combined sales tax rate to 7.46%.

However the local sales tax rate can be as high as 2%, which would mean the maximum combined sales tax could be 8.87%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Minesota.

James Allen sales tax in Mississippi

The state sales tax is 7% and the average local sales tax rate is 0.07%, which brings the combined sales tax rate to 7.07%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 8%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Mississippi.

James Allen sales tax in Nebraska

The state sales tax is 5.50% and the average local sales tax rate is 1.44%, which brings the combined sales tax rate to 6.94%.

However the local sales tax rate can be as high as 2.50%, which would mean the maximum combined sales tax could be 8%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Nebraska.

James Allen sales tax in Nevada

The state sales tax is 6.85% and the average local sales tax rate is 1.38%, which brings the combined sales tax rate to 8.23%.

However the local sales tax rate can be as high as 1.53%, which would mean the maximum combined sales tax could be 8.38%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Nevada.

James Allen sales tax in New Jersey

The state sales tax is 6.625% and the average local sales tax rate is -0.03% (this anomaly is thanks to Salem County which is not subject to the state rate, and has a local rate of 3.3125%) which brings the combined sales tax rate to 6.60%.

However the local sales tax rate can be as high as 3.313%, which would mean the maximum combined sales tax could be 9.938%

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from New Jersey.

James Allen sales tax in New Mexico

The state sales tax is 5.125% and the average local sales tax rate is 2.71%, which brings the combined sales tax rate to 7.83%.

However the local sales tax rate can be as high as 4.313%, which would mean the maximum combined sales tax could be 9.438%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from New Mexico.

James Allen sales tax in New York

The state sales tax is 4% and the average local sales tax rate is 4.52%, which brings the combined sales tax rate to 8.52%.

However the local sales tax rate can be as high as 4.875%, which would mean the maximum combined sales tax could be 8.875%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from New York.

James Allen sales tax in North Carolina

The state sales tax is 4.75% and the average local sales tax rate is 2.23%, which brings the combined sales tax rate to 6.98%.

However the local sales tax rate can be as high as 2.75%, which would mean the maximum combined sales tax could be 7.5%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from North Carolina.

Read related article: Are James Allen diamonds real?

James Allen sales tax in North Dakota

The state sales tax is 5% and the average local sales tax rate is 1.96%, which brings the combined sales tax rate to 6.96 %.

However the local sales tax rate can be as high as 3.50%, which would mean the maximum combined sales tax could be 8.50%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from North Dakota.

James Allen sales tax in Ohio

The state sales tax is 5.75% and the average local sales tax rate is 1.48%, which brings the combined sales tax rate to 7.23%.

However the local sales tax rate can be as high as 2.25%, which would mean the maximum combined sales tax could be 8%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Ohio.

James Allen sales tax in Oklahoma

The state sales tax is 4.5% and the average local sales tax rate is 4.45%, which brings the combined sales tax rate to 8.95%.

However the local sales tax rate can be as high as 7%, which would mean the maximum combined sales tax could be 11.5%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Oklahoma.

James Allen sales tax in Pennsylvania

The state sales tax is 6% and the average local sales tax rate is 0.34%, which brings the combined sales tax rate to 6.34%.

However the local sales tax rate can be as high as 2%, which would mean the maximum combined sales tax could be 8%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Pennsylvania.

James Allen sales tax in Rhode Island

The state sales tax is 7% but here’s no local state tax. Which means the most you’ll ever pay for sales tax in Rhode Island is 7%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Rhode Island.

James Allen sales tax in South Carolina

The state sales tax is 6% and the average local sales tax rate is 1.46%, which brings the combined sales tax rate to 7.46%.

However the local sales tax rate can be as high as 3%, which would mean the maximum combined sales tax could be 9%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from South Carolina.

James Allen sales tax in South Dakota

The state sales tax is 4.5% and the average local sales tax rate is 1.9%, which brings the combined sales tax rate to 6.4%.

However the local sales tax rate can be as high as 4.5%, which would mean the maximum combined sales tax could be 9%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from South Dakota.

James Allen sales tax in Tennessee

The state sales tax is 7% and the average local sales tax rate is 2.55%, which brings the combined sales tax rate to 9.55%.

However the local sales tax rate can be as high as 2.75%, which would mean the maximum combined sales tax could be 9.75%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Tennessee.

James Allen sales tax in Texas

The state sales tax is 6.25% and the average local sales tax rate is 1.94%, which brings the combined sales tax rate to 8.19%.

However the local sales tax rate can be as high as 2%, which would mean the maximum combined sales tax could be 8.25%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Texas.

James Allen sales tax in Utah

The state sales tax is 6.1% and the average local sales tax rate is 1.09%, which brings the combined sales tax rate to 7.19%.

However the local sales tax rate can be as high as 2.95%, which would mean the maximum combined sales tax could be 9.05 %.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Utah.

James Allen sales tax in Vermont

The state sales tax is 6% and the average local sales tax rate is 0.24%, which brings the combined sales tax rate to 6.24%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 7%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Vermont.

James Allen sales tax in Virginia

The state sales tax is 5.3% and the average local sales tax rate is 0.43%, which brings the combined sales tax rate to 5.73%.

However the local sales tax rate can be as high as 0.7%, which would mean the maximum combined sales tax could be 6%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Virginia.

James Allen sales tax in Washington

The state sales tax is 6.5% and the average local sales tax rate is 2.73%, which brings the combined sales tax rate to 9.23%.

However the local sales tax rate can be as high as 4%, which would mean the maximum combined sales tax could be 10.5%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Washintgon.

James Allen sales tax in West Virginia

The state sales tax is 6% and the average local sales tax rate is 0.5%, which brings the combined sales tax rate to 6.5%.

However the local sales tax rate can be as high as 1%, which would mean the maximum combined sales tax could be 7%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from West Virginia.

James Allen sales tax in Wisconsin

The state sales tax is 5% and the average local sales tax rate is 0.43%, which brings the combined sales tax rate to 5.43%.

However the local sales tax rate can be as high as 1.75%, which would mean the maximum combined sales tax could be 6.75%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Wisconsin.

James Allen sales tax in Wyoming

The state sales tax is 4% and the average local sales tax rate is 1.33%, which brings the combined sales tax rate to 5.33%.

However the local sales tax rate can be as high as 2%, which would mean the maximum combined sales tax could be 6%.

Use James Allen’s tax calculator to understand how much you will need to pay on your ring when buying from Wyoming.

Read related article: James Allen Financing

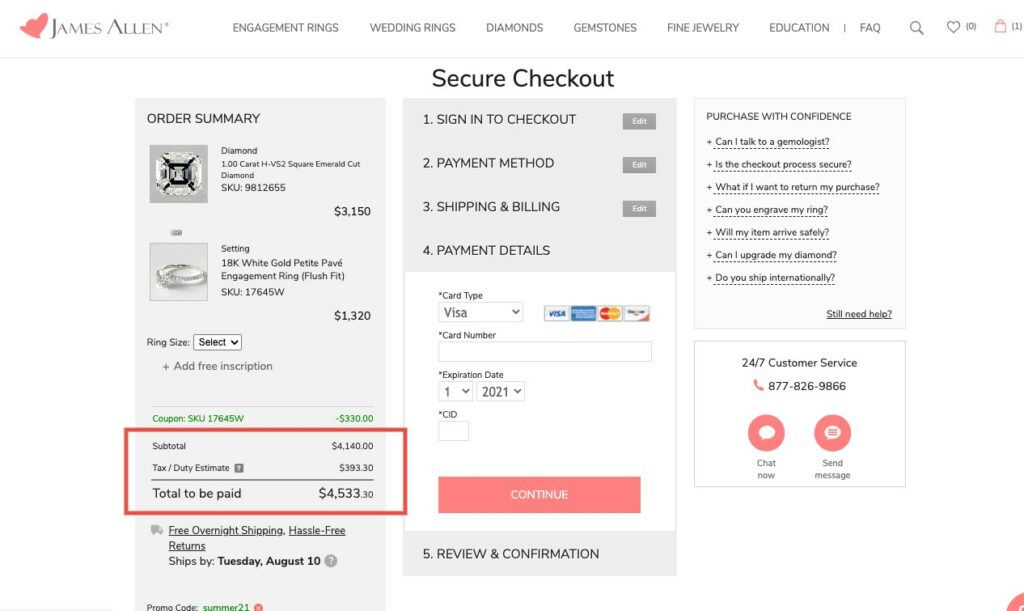

James Allen will charge you the correct amount of tax

James Allen calculates the tax for you in the cart, and it’s will be included in the total amount you have to pay. This is made transparent in the cart totals and you’ll be able to see this after you enter in a shipping address.

They also have a handy tax calculator you can access (click here) if you want to see how the tax can fluctuate from state to state.

Is there any way you can avoid paying tax?

To avoid paying sales tax, you’d need to either live in Delaware, Montana, New Hampshire, Oregon, Florida or Missouri or know someone that lives in those states and get the ring sent to them, and then get them to send it to you.

If you wanted to pay less tax, you could get the ring mailed to another state that has a lower tax rate. If you have time up your sleeve this might be worth your while.

Visit James Allen tax calculator now