Importing a diamond ring into Canada

Everything you need to know about importing an engagement ring or any other diamond jewelry into Canada

If you are looking for the best places to buy an engagement ring in Canada and finding that your local Peoples, Birks, Charm or Michael Hill just isn’t cutting it, you may be wondering importing an engagement ring could offer more choice, and better value than local jewellers?

The good news is, it almost certainly will.

The US is home to the biggest online jewellers in the world, with a huge selection of diamonds that even the best Canadian jewellers just can’t match.

Retailers like James Allen or Brilliant Earth have hundreds of thousands of diamonds available at any one time, which means more choice and more value for you.

But there are a few things to think about before deciding whether importing a diamond ring into Canada is the right choice for you.

1. Foreign Exchange rates

The relative strength of the Canadian dollar to the US$ can play a huge part in how attractive it is to import a diamond or engagement ring into Canada.

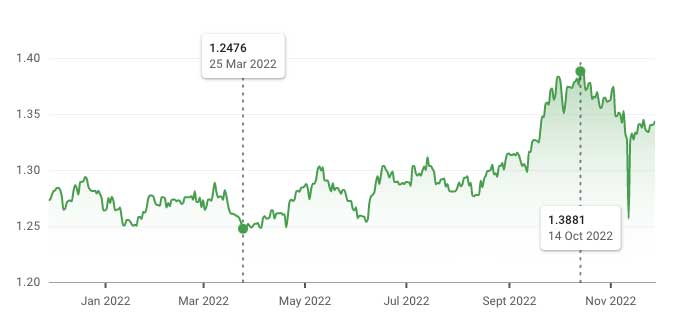

In the last 12 months since the time of writing, the US dollar has hit the following extremes agains the Canadian dollar:

- Low: $1.2476

- High: $1.3881

This makes a big difference to how much a diamond or engagement ring would cost.

At the $1.2476 rate, a C$10,000 budget would be equal to US$8,015

Conversely, at the $1.3881 rate, your budget in the US would be just US$7,204.

This can make a big difference to the ring that your budget can stretch to.

While foreign exchange rates are outside our control, I wanted to include it to explain that, while I recommend US retailers a lot, they aren’t always the best option. The exchange rate at the time that you are looking to buy will make a big difference to their competitiveness.

2. Duty

Under the currently valid USMCA regulations, any diamond ring that is manufactured in the US does not have any duty applied to it.

This is consistent with the previous NAFTA trade deal and means that there are no additional taxes applied to a diamond ring bought from the US compared to a local jeweller.

3. Tax

Jewellery is still subject to your provinces sales tax, which means there’s no avoiding it unfortunately.. Unless you can organise a sneaky border run.

And depending on where you live and your province’s PST, it may make a big difference about whether it makes more sense to import your engagement ring from the US, or buy locally.

In the sections below, we’ll look at each province and what an example budget of C$10,000 could get you if you were to buy within the US. While your budget may be different to this, it’s a nice round number and a good comparison point for comparing to local retailers.

Calculating the tax to import a ring into Canada

Working out the exact tax that needs to be paid can be pretty tricky, but James Allen have provided a great sales tax calculator which calculates the tax for every province.

You can enter the cost of your ring and find out the total of the tax and any other charges that will be payable.

Click here to check it out.

In the sections below, we’ll look at each province and what an example budget of C$10,000 could get you if you were to buy within the US. While your budget may be different to this, it’s a nice round number and a good comparison point for comparing to local retailers.

Click below to jump to your province to find out about whether it makes sense to important a diamond or engagement ring:

- Ontario

- Quebec

- British Columbia

- Alberta

- Manitoba

- New Brunswick

- Nova Scotia

- Newfoundland and Labrador

Importing an engagement ring into Ontario

Whether you are looking for the best place to buy an engagement ring in Toronto, or considering importing a ring in from the US, there’s one thing that is difficult to avoid: HST.

The 13% isn’t quite as bad as some other provinces, but it still affects how far a budget will go. If we look at a total theoretical budget of C$10,000 then we need to allow C$1,050 to cover taxes. This leaves us C$8,850 for the ring itself.

So what can this budget get us from a US-based retailer?

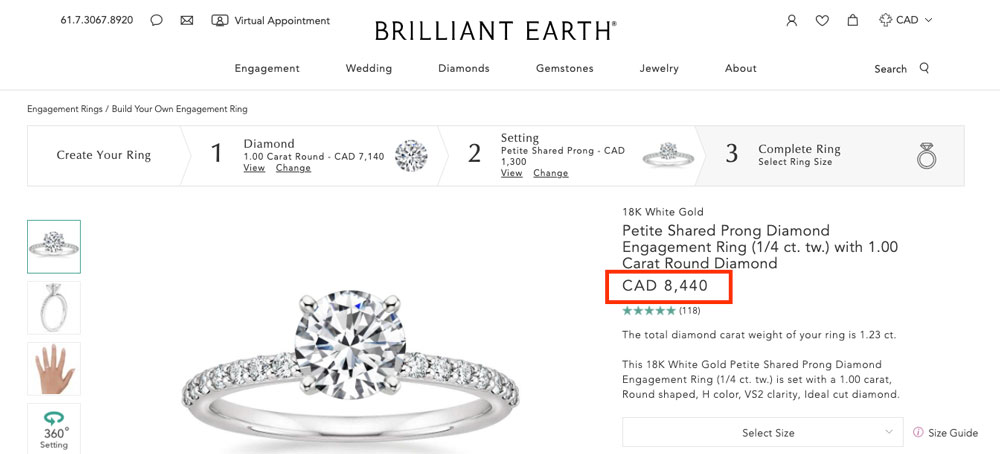

By buying smart, this budget can deliver a stunning ring. It can accommodate a 1 carat diamond with an ‘ideal’ cut great and good colour and clarity, plus a pavé setting that adds additional carat weight too.

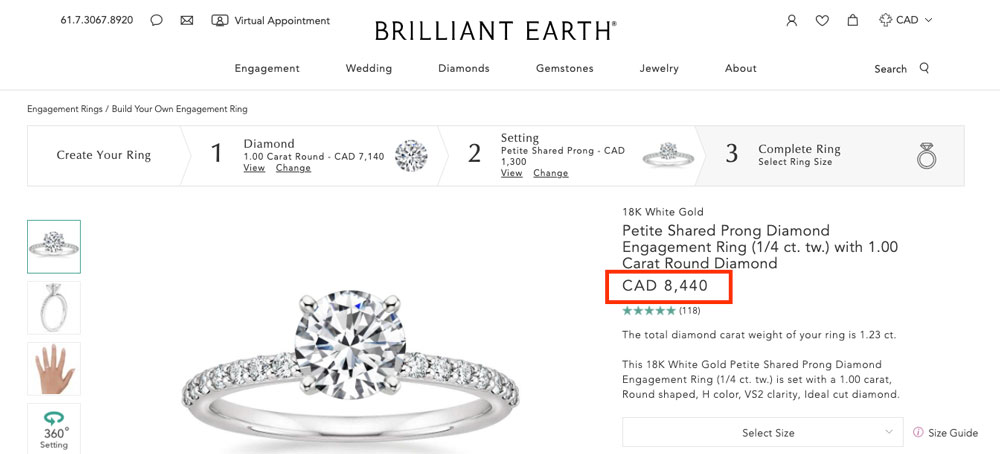

With nearly the 1/4 of a carat in the setting, the ring has a total carat weight of diamonds of 1.23 carats:

The diamond itself is $7,140, while the setting is $1,300, for a total of $8,440.

If you’re considering buying your engagement ring within Canada and want to know whether it makes sense to buy locally or import, then this ring is a good one to compare against.

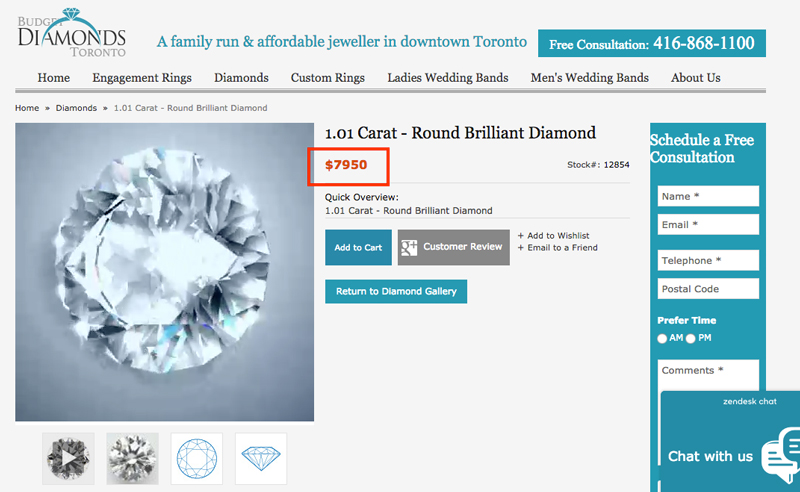

If we look at a local jeweller in Toronto, a similarly specced 1.01 carat diamond costs $7,950 (note, this doesn’t include HST):

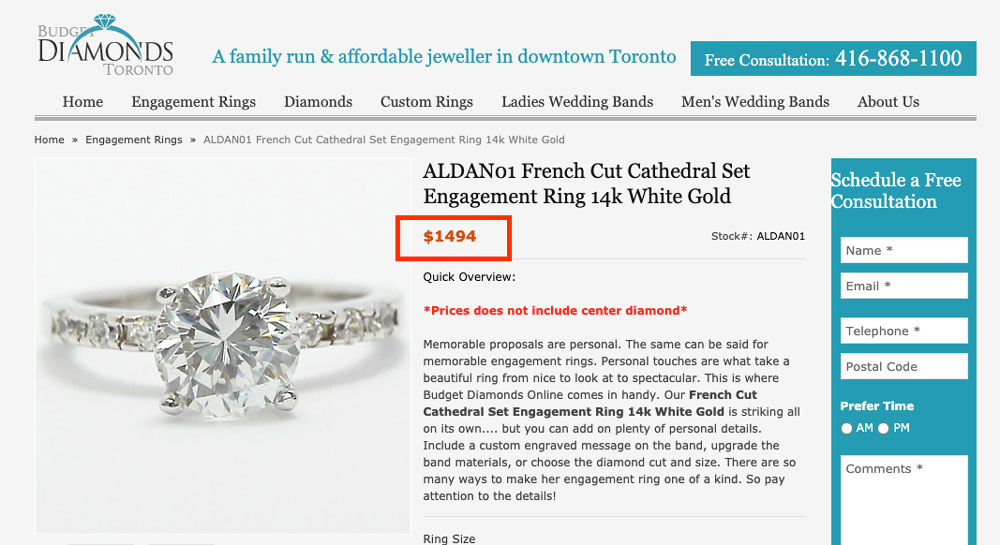

A pavé setting costs $1,494 (although this one has 14k white gold instead of the 18k white gold in the Brilliant Earth setting):

The total for this ring is therefore $9,444 – $1,004 more than a similarly specced ring from Brilliant Earth.

If you’re looking to get the most value possible, and avoid overpaying, it would definitely be worth consider importing a diamond ring into Ontario, rather that buying locally – the money you save could be put towards an incredible proposal, or your wedding.

Your budget and what you are looking for will be different to the example used, but to see how your budget will be affected by taxes, it’s a good idea to use the tax calculator here.

Importing an engagement ring into Québec

As I’m sure you’re aware, Quebec has one of the highest rates of taxes on products in the country, with 14.975% being levied across everything when GST and QST are considered together.

And whether you’re looking to buy locally, or import from abroad, taxes will need to be paid. If we take a theoretical total budget of C10,000, we need to allow for $1,300 within this.

This leaves a budget of C$8,700, or around $6,700 at a 1.3 exchange rate.

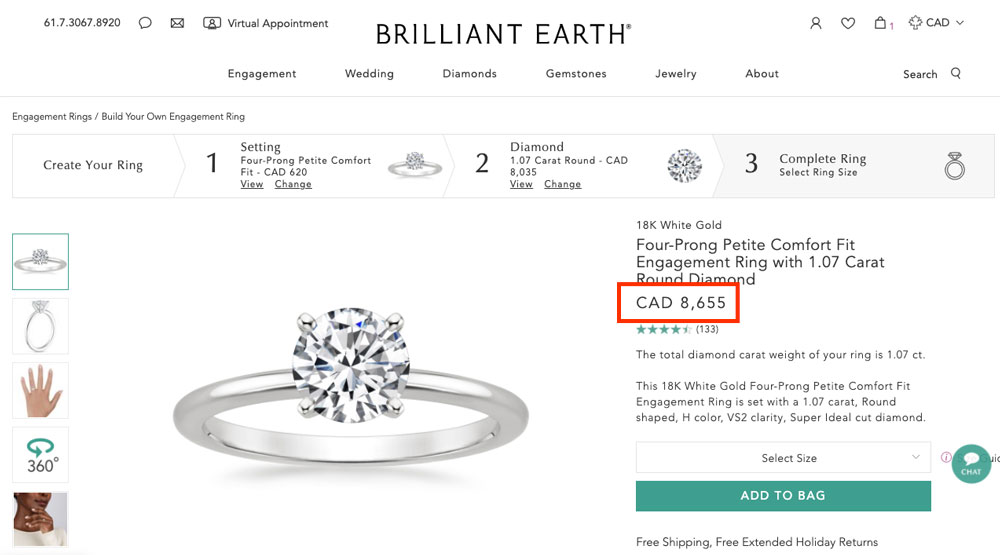

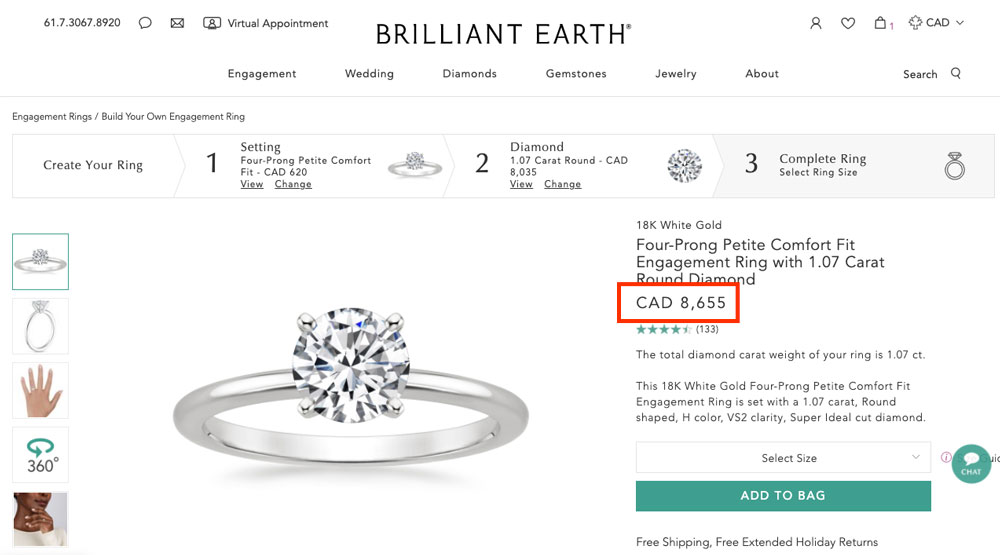

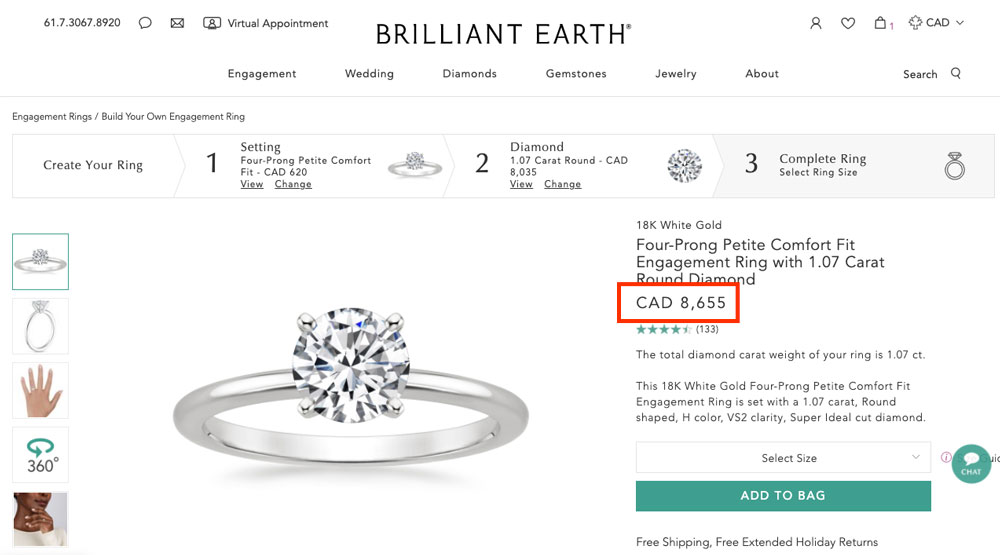

If you were to from one of my recommended retailers, your budget would stretch to a 1.07 carat center diamond, graded by the GIA, with H color and VS2 clarity on a simple, 18k white gold solitaire setting:

The cost for the diamond os $8,035, while the setting is $620.

Buying an engagement ring in Quebec vs. importing

Buying a diamond ring in Montreal is likely to be far more expensive than importing from the US.

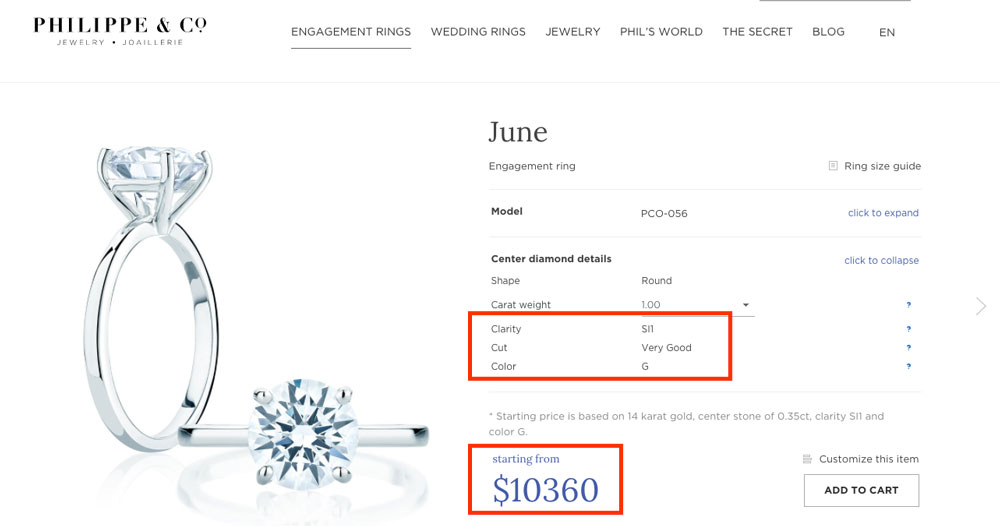

Looking at Philippe & Co, a jeweller based in Montreal, they are charging $10,360 for a 1 carat solitaire setting with worse quality – only SI1 clarity and ‘very good’ cut:

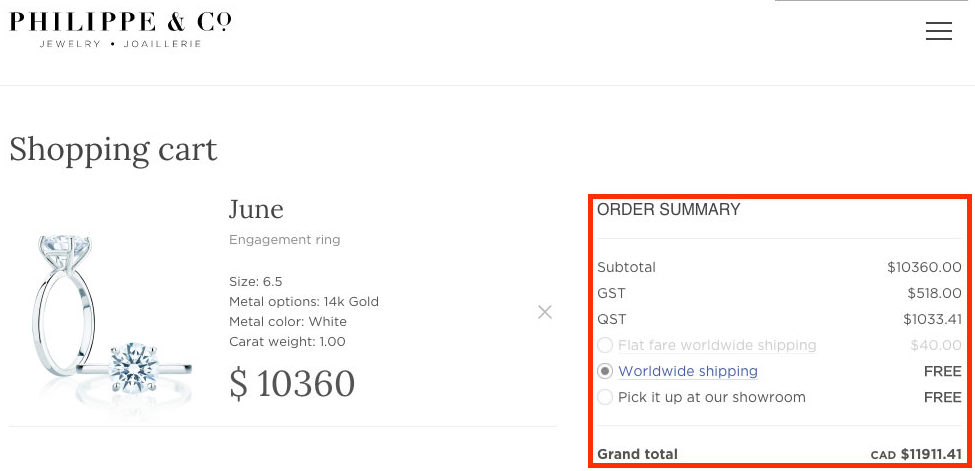

This price also doesn’t include tax, which would bring the total up to $11,911:

Buying locally within Montreal could therefore cost you $2,000 more than buying from a US-based retailer like Brilliant Earth.

Your budget and what you are looking for will be different to the example used, but to see how your budget will be affected by taxes, it’s a good idea to use the James Allen sales tax calculator.

Importing an engagement ring into British Columbia

When Importing a diamond or engagement ring into BC, we need to take into account both the 7% PST and the 5% GST, which does eat into the budget available for the ring itself.

If you have a budget of CA$10,000, for example, then around $1,070 of this will be eaten up by sales taxes, leaving you with a budget of CA$8,930

This is the case whether you buy in the Canada or the US, but it’s helpful to know this number when shopping on US websites to gauge your price.

So, what can a budget of nearly CA$9,000 get you from a US retailer?

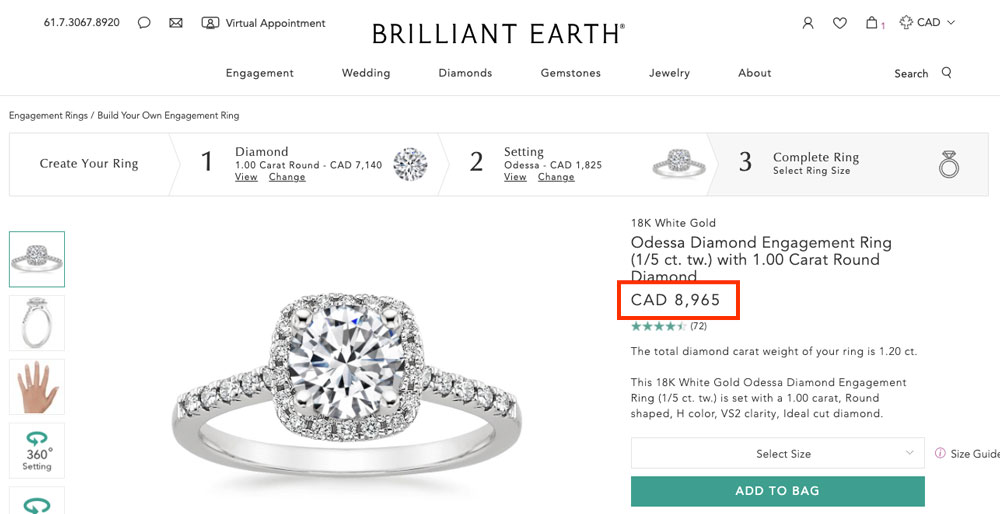

It can get a great ring! This budget allows for a 1 carat round brilliant with ‘ideal’ cut grade, plus a halo setting with an additional 1/5 of a carat of melee diamonds set into the halo and band, for a total of 1.2 carats:

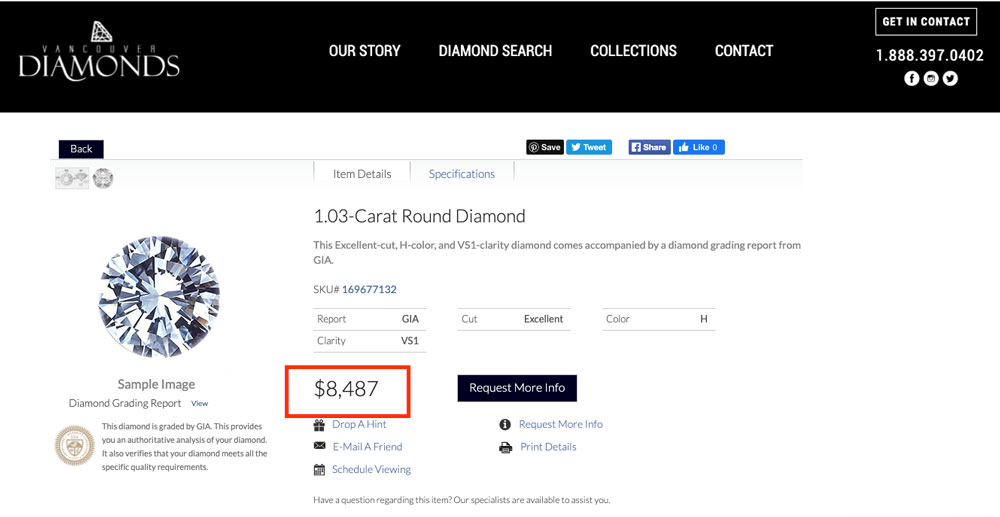

If we look at a Vancouver based retailer, ‘Vancouver diamonds’, they are charging $8,487 for a 1 carat, excellent cut, VS1 clarity, H colour diamond:

This is a great spec for a ring which delivers high quality without asking you to spend more on things that don’t make a visible difference to what the ring looks like. If you aren’t sure why this spec is so good, there are many excellent guides to diamond quality, etc online.

This retailer doesn’t provide prices for settings on its website, but the fact that the diamond is $1,300 more expensive than the diamond from Brilliant Earth reinforces the value that buying an engagement ring online and importing it into British Columbia can deliver.

Your budget and what you are looking for will be different to the example used, but to see how your budget will be affected by taxes, it’s a good idea to use the sales tax calculator here.

Importing an engagement ring into Alberta

As I’m sure you’re aware, Alberta is one of the only provinces that doesn’t have a Provincial Sales Tax on top of the national GST, which leaves you more budget for your ring.. Bonus!

With just the 5% GST to pay, if you wanted to spend CA$10,000 on your ring, then around C$470 of your budget would need to be put aside for tax, leaving CA$9,530 to purchase the ring itself.

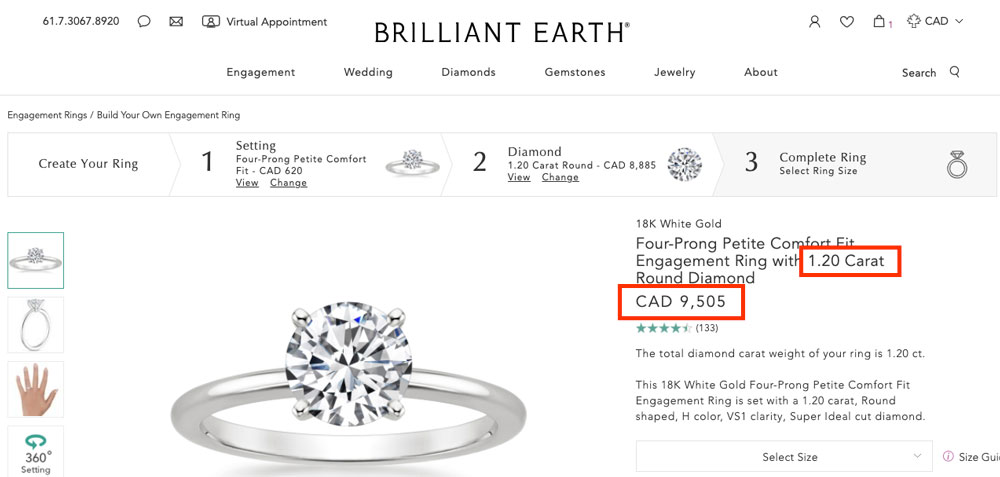

Getting an engagement ring budget to match a budget exactly can be difficult because it depends on the availability of the diamonds in the market at that time, but a CA$10,000 budget could stretch to a solitaire diamond engagement ring with the following specs:

- Carat: 1.20

- Color: H

- Clarity: VS1

- Cut: Ideal

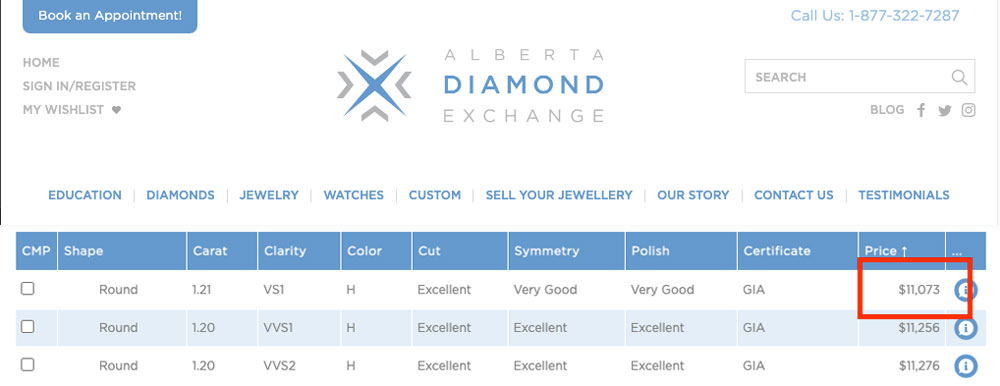

Looking at an Edmonton jeweller and a 1.2 carat, VS1, H colour diamond is price at $11,073, not even including the setting:

Comparing this with the $9,505 that Brilliant Earth are asking, it’s clear than buying an engagement ring online and importing it into Alberta can deliver significantly more value.

Your budget and what you are looking for will be different to the example used, but to see how your budget will be affected by taxes, it’s a good idea to use the James Allen sales tax calculator.

Importing an engagement ring into Manitoba

If you are looking to import a diamond engagement ring into Manitoba, you’ll need to allow for 5% GST and 8% PST, just as you would if you were buying within the province.

When shopping at US retailers, you’ll need to allow for this in their pricing. If we take a total budget of C$10,000, for example, then we need to allow C$1,050 to cover taxes. This leaves us C$8,850 for the ring itself, or around US$6,800 at a 1.3 exchange rate.

So what can this budget get us from a US-based retailer?

By buying smart, this budget can deliver a stunning ring. It can accommodate a 1 carat diamond with an ‘ideal’ cut great and good colour and clarity, plus a halo setting that adds additional carat weight too.

With the 1/4 of a carat in the setting, the ring has a total carat weight of diamonds of 1.25 carats.

If you’re considering buying your engagement ring within Canada and want to know whether it makes sense to buy locally or import, then this ring is a good one to compare against.

Buying an engagement ring in Winnipeg vs. importing

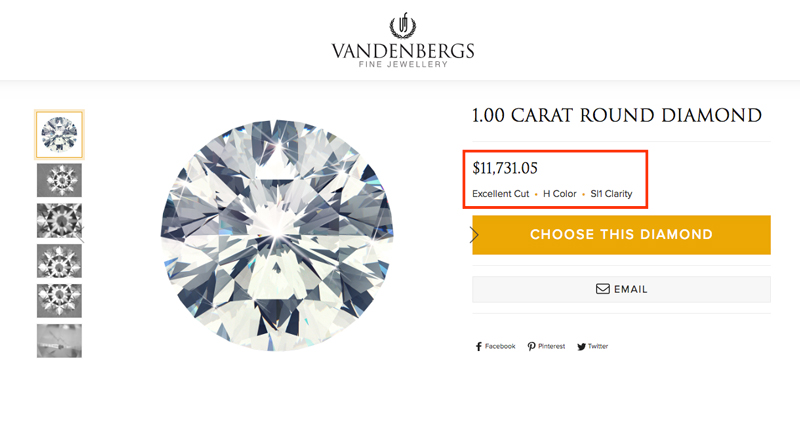

To compare, I found a Manitoba-based jeweller to see how a local retailer compared.

Looking for a diamond with similar carat weight and quality, the local Winnipeg jewellers were noticeably more expensive. A 1 carat GIA graded stone with H color and lower clarity – SI1 – was $11,700:

Once the cost of the setting is added, this will be even more expensive than the Brilliant Earth ring – if you are in Manitoba and you are keen to get the most most value possible, it would definitely be worth consider importing a diamond ring into Canada, rather that buying locally.

Your budget and what you are looking for will be different to the example used, but to see how your budget will be affected by taxes, it’s a good idea to use the tax calculator here.

Importing an engagement ring into New-Brunswick

Just as if you were buying your engagement ring in New Brunswick, if you are looking to import a diamond or a ring then you will need to allow for the local taxes within your budget.

In New Brunswick, we therefore need to allow for the 15% HST, which takes a bit of a bite out of our budget. If we look at a theoretical C$10,000 for our engagement ring, we will need to allow $1,305 to cover the HST. This leaves us with C$8,695 for the ring itself, or around US$6,690.

What does this budget buy us and how does it compare to buying a diamond ring within New Brunswick?

If you were to from one of my recommended retailers, your budget would stretch to a 1.07 carat center diamond on a simple, 18k white gold solitaire setting:

Buying an engagement ring in New Brunswick vs. importing

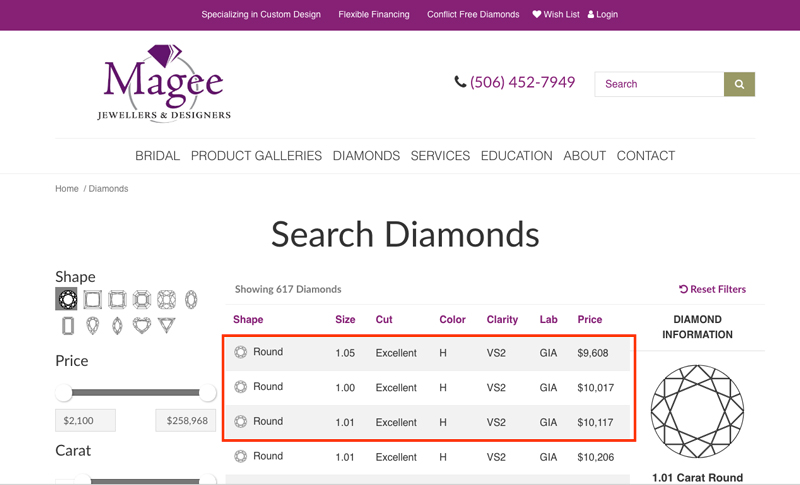

If you were to buy a diamond within New Brunswick, it’s unlikely that you would be able to match the value offered by US retailers.

Searching on a local Fredericton-based jewellers, shows that a 1 carat stone with GIA certification and similar specs for quality as the Brilliant Earth diamond starts at around C$9,500 on its own, and then increases. Plus the cost of a setting. Plus taxes.

It therefore appears that importing an engagement ring into New Brunswick will allow you to get a larger, and higher quality diamond than buying locally.

Your budget and what you are looking for will be different to the example used, but to see how your budget will be affected by taxes, it’s a good idea to use the James Allen taxes calculator here.

Importing an engagement ring into Nova Scotia

Whether you are looking to buy an engagement ring in Halifax, or import one from the USA, there is no escaping HST. The 15% haircut definitely affects the buying power when it comes to engagement rings.

Looking at an example budget of $10,000, we need to allow $1,305 for HST, which leaves us with C$8,695 for the ring itself, or around US$6,690.

What does this budget buy us and how does it compare to buying a diamond ring within Nova Scotia?

If you were to from one of my recommended retailers, your budget would stretch to a 1.07 carat center diamond on a classic, 18k white gold solitaire setting:

While this budget and style of setting from Brilliant Earth may not be exactly what you are looking for, this price is a good yardstick to measure local jewellers against.

Your budget and what you are looking for will be different to the example used, but to see how your budget will be affected by taxes, it’s a good idea to use the tax calculator here.

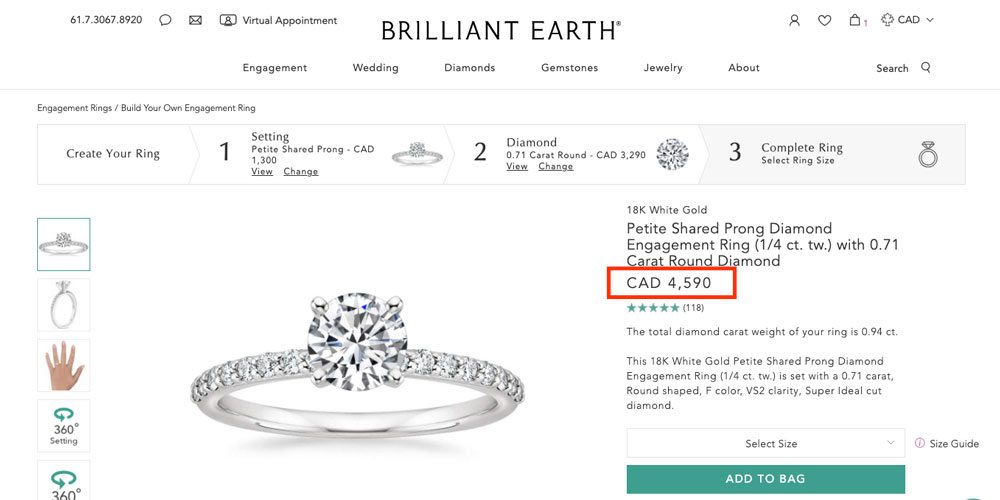

Importing an engagement ring into Newfoundland and Labrador

When it comes to jewellery, there’s no avoiding HST, whether you are buying your diamond ring within the province, or importing it from the USA.

When calculating your budget, you therefore need to allow for HST when determining just what you will be able to get for your budget.

If we look at an example budget of C$5,000, allowing for 15% HST gives us around C$4,350 for the diamond and ring setting, which equates to around US$3,346 at a 1.3 exchange rage.

What does this budget buy us and how does it compare to buying a diamond ring within Newfoundland?

If you were to from one of my recommended retailers, your budget would stretch to a 0.71 carat GIA graded center stone with super ideal cut, F colour and VS2 clarity, plus a halo setting with an additional 1/4 carat of diamonds in the setting to bring it to 0.96 carats.

While this budget and style of setting from Brilliant Earth may not be exactly what you are looking for in terms of budget or ring style, it’s a good yardstick to judge local retailers against.

Your budget and what you are looking for will be different to the example used, but to see how your budget will be affected by taxes, it’s a good idea to use the tax calculator here.

Should you import an engagement ring into Canada?

Whether importing your diamond ring into Canada is right for you is a decision I can’t help with, unfortunately. But I would say that before you decide either way, you have a look at US retailers and see how they compare to local jewellers.

Importing and engagement ring won’t always be the best option. It depends on many factors, including the particular ring that you are looking at and then bigger factors like current exchange rates too.

Two of the retailers I recommend the most when helping people import a diamond from the US to Canada are Brilliant Earth and James Allen and I have specific guides to everything you need to know about importing a diamond ring from each of these retailers here: